UK Property Market: Mini Boom

- sort style and stage

- Jul 27, 2020

- 4 min read

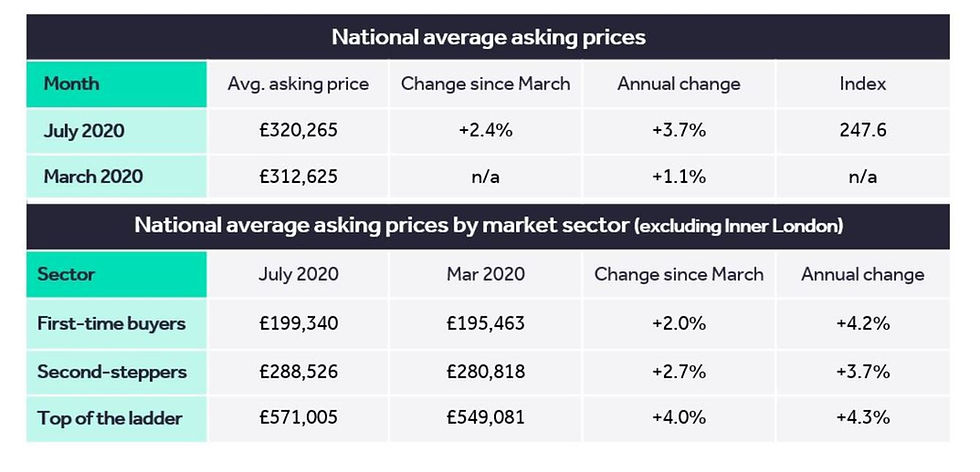

Rightmove have published their July House Price Index. This confirms the UK is experiencing a "mini boom". Not only is there an increase in activity, average asking prices are 2.4% higher than in March and the annual increase of 3.7% is the highest since December 2016. This makes the average house price now £320,265.

Other key metrics are:

Since the beginning of July, buyer enquiries are up 75% year on year

Since the housing market opened up again on 13 May 2020, 44% of these new listings are now agreed sales compared to 34% for the equivalent dates last year

Monthly sales are up 15% in England on last year

In the 5 days after the stamp duty announcement, sales levels jumped to 35% compared to the same time last year

Total available housing stock is now just 13% down in Great Britain

The number of properties coming to market is up by 11.1% this month compared to a year ago (despite Scotland and Wales not contributing for the full period)

There are more low deposit mortgages available for up to 90% of the purchase price, which is especially good to get the first time tranche of buyers moving

The stamp duty holiday may encourage more households to the market so they ensure they have plenty of time to move before 31 March 2021 deadline when this will stop.

Last month, the Rightmove Index could only refer to English data however this Index is a national index.

Miles Shipside, Rightmove Director and Housing Market Analyst says:

“The unexpected mini-boom continues to gather momentum as more nations reopen. Overall buyer enquiries are up by an incredible 75% year-on-year in Britain and we expect activity will increase even further as Scotland has not yet been open for a full month, and Wales still has some housing market restrictions in place.

The busy until interrupted spring market has now picked up where it left off and has been accelerated by both time-limited stamp duty holidays and by homeowners reappraising their homes and lifestyles because of the lockdown. The strength of buyer demand has contributed to record prices, with the 3.7% annual rate of increase being the highest for over three and a half years. These figures are the earliest indicator of house price trends. They show on average prices gently rising not falling, and this will be reflected in the coming months in other house price reports.”

And:

"There is a window of opportunity for sellers to come to market and to find a buyer who is tempted by the stamp duty savings. Although March next year may sound like a long time away, in reality sellers need to find a buyer before Christmas, to allow a further three months for completion of the legal process to beat the deadline. While property is selling much faster than a year ago, it’s important not to over-price and miss this window. It’s still a price sensitive market with buyers having limits on what they are able to borrow, and the uncertain economic outlook making them more cautious.”

And:

"While most first-time buyers will not benefit from the stamp duty holiday, as they were already exempt from stamp duty on purchases of up to £300,000, many will benefit from lenders now starting to bring back first-time buyer mortgages for up to 90% of the purchase price. Lower-deposit lending helps to boost buyer activity on the all-important first rung of the ladder, which in turn helps to boost the numbers of second-steppers who are able to trade up, and so also enables others higher up the chain to move.”

Image: Rightmove

To learn more, click here.

Are you Thinking of Selling?

If you are one of those households that now want to move, do you want to sell for more and quickly? If the answer is YES, we can show you how - read on.

Maximising Your Chances of Selling

Put yourself in the shoes of your potential buyers for a moment. Home buying is an emotional investment. To attract your buyer, you need to create a home which is going to trigger the emotional connection in your buyer's mind. Our home staging service does just that. Our client's properties sell for more and quickly because:

1. We address head on any Red Flags

Before we begin to think about staging your home, it's important to address any red flags. So what is a red flag? A red flag is any maintenance or repair job that you've not tackled. Buyers will notice and fixate on these if they are not addressed. If you don't address these red flags now, they will either trip you up (excuse the pun) during viewings or later on at the survey stage.

2. We know Your Local Market

It's no good putting your head in the sand and ignoring what your direct competitors are doing with their homes. We fully research your local market so we know up front what needs to be done to give your home the head start on the competition.

3. We understand the dynamics of the Housing Market

We pride ourselves on our knowledge of the housing market and use this insight to the advantage to benefit our own developments and those of our clients.

4. We understand General Buyer Behaviour

Having sold and bought many properties from entry level through to executive family homes, we understand first hand buyer behaviour and use this to benefit you.

5. We Stage your Home Beautifully (Inside and Out)

We use cost effective targeted solutions in our staging to make sure that your home becomes the dream home for your buyers. We also work quickly to get this done ensuring high quality throughout with our tailored, personal service.

Don't hesitate any further. If you want to maximise your chances of selling, reach out to us at info@sortstyleanstage.com to book your free no-obligation appointment.

We can't wait to hear from you

Comments